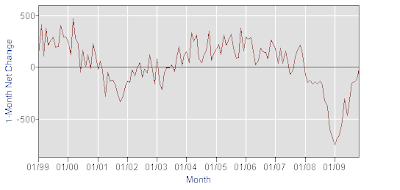

It is not only that November's decline in payrolls was a mere 11,000 but, even perhaps even more importantly, there was a massive net cumulative upward revision of 159,000 in the payroll data for the prior two months. The result is a dramatically different profile of recent payroll trends, showing a faster improvement than previously thought. Payroll declines in the last 3 months have averaged 87,000 a month versus average declines of 307,000 in the preceding 3-month period and -491,000 in the 3-month period prior to that.

Source: Bureau of Labor Statistics

Adding impetus to the impressive strength of the report- compared to the relatively recent past- the average workweek rose to 33.2 hours from its cycle-low of 33.0 hours. Any moderate sustained rise in the workweek is usually viewed as a precursor of more hiring down the line, as there are limits as to how intensively employers can utilize their existing labor force before adding to it. The manufacturing workweek also jumped by 0.3 hours to 40.4, supporting evidence of a significant turnaround in that sector, as manifested by the ISM and other manufacturing surveys in recent months.

Both construction and manufacturing employment fell last month, by 27,000 and 41,000 respectively, but these are two sectors unlikely to become significant sources of job creation in the foreseeable future, as construction is likely to remain in deep freeze for some time and the bulk of increased output in manufacturing recently comes from a rise in productivity. It is also a sign of the ongoing caution that employers are still exercising in terms of hiring that temporary jobs rose by 57,000 in November and have increased by a total 117,000 since July.

However, all of the still present pockets of weakness in the payroll data need to be understood in the context of the dynamic that prevails around turning points of the cycle- meaning that not all sectors will be showing the same measure of improvement simultaneously and this is likely to be particularly true this time in view of the severity of the last recession and the major dislocations it has caused.

With the pace of layoffs slowing precipitously in the last several weeks, as measured by a strong downtrend in initial unemployment claims, monthly payroll data are poised to start turning positive in the coming months. In fact, the most reasonable expectation at this point is that by early next year, we will start seeing modest to moderate monthly gains, while the unemployment rate may continue to linger around its cycle-highs. But today's report, along with the totality of the other pieces of economic data recently, suggests that the impetus that this economic recovery is having may have been seriously underestimated.

Anthony Karydakis