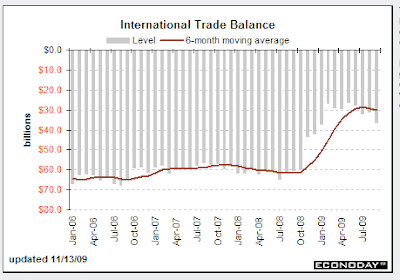

The effectiveness of that "prescription" has now been tested and fully validated; in fact, at first glance, it has passed with flying colors. After totaling approximately $700 billion in both 2007 and 2008, the international trade balance of goods and services is now on track to be a little over half that amount in the current year. Differently put, average monthly deficit numbers close to $60 billion in 2007 and most of 2008 have been running at an average of $30 billion a month since the beginning of the year. While both exports and imports have suffered in the midst of the global economic downturn, imports have declined by 80% in the first nine months of 2009 versus a 62% drop in exports during that period- resulting in the dramatic improvement in the overall deficit.

While this certainly seems to be good news, there is not much encouragement one can derive regarding the prospects for the deficit over the medium-term. As the U.S. economy slowly exits its recession, and most other countries are recovering to various degrees, the U.S. trade deficit is bound to slowly deteriorate again over the next 12 to 24 months. In fact, to a considerable extent, that was the key message from last week's report on the September deficit, which widened sharply to $36.5 billion from $30.8 billion in August. As consumer spending picked up dramatically in the third quarter, so did imports. While a good part of the 5.8% surge in overall imports was due to a higher petroleum import bill and automotive imports related to the cash-for-clunkers program, the reality is that the spectacular improvement that the deficit showed in the first half of the year- averaging $27.7 billion a month between February and June, at the depth of the recession- is already behind us and a partial reversal of that process is already underway as the U.S. economy recovers.

Source: Bloomberg, Haver Analytics

The moderate overall decline of the dollar on a trade-weighted basis since February has often been mentioned as a key factor for this year's improvement in the trade deficit so far. However, this is unlikely to have been a crucial factor. There are significant lags between the time a sustained decline in the value of a currency takes place and its impact on the trade balance of that country; these two forces are not contemporaneous, as pre-existing pricing contracts in international trade remain in effect for a while- irrespective of changes in the exchange rates involved in the interim- until the time comes for such contracts to be renegotiated. Given that the dramatic improvement in the trade numbers occurred in the period between November 2008 (prior to the start of the dollar's slide) and June 2009, it is unlikely that the weaker dollar has been an appreciable factor so far.

The lower dollar will be somewhat helpful in containing the amount of deterioration that the U.S trade deficit is likely to suffer over the next twelve months. Once again, though, that factor should not be overestimated as the dollar may recoup some of its lost ground in 2010, when the Fed starts being viewed as approaching the time when they will be doing away with the zero short-term rate policy.

This leaves the pace of the U.S. economic recovery, particularly compared to the rest of the world, as the key determinant of the direction of the trade deficit from here. While the U.S. recovery may be somewhat choppy and of the historically moderate kind, the same is likely to be the case for at least two of our key trading partners: Euro zone and Japan; so, not much relief on that front.

Given a) the heavy pent-up demand that has been created in the last 18 months or so in the U.S. in the midst of a particularly scary economic and financial market environment, b) the fact that a stabilization of labor markets (with encouraging signs of further improvement in the "pipeline") is already underway, paving the way for a pick-up in consumer spending, and c) that personal consumption represents a whopping 70% of the U.S. economy, the most likely outcome of all of this is that a sustained increase in the demand for imports will cause the trade deficit to deteriorate moderately again in 2010. The stronger the economic recovery turns out to be, the wider the deficit should get. It would not return quickly to pre-recession levels, but it will probably move closer to the $450 billion plus range next year, compared to $375 billion or so this year.

So, the recession will turn out to have been not a real "cure" for the trade deficit but rather a short-acting medicine of sorts. The true cure would be a fundamental reorientation of the U.S. economy away from spending and toward more saving- a prospect that does not look very promising at all.

Anthony Karydakis